Tax withholding payroll calculator

Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Get the Payroll Tools your competitors are already using - Start Now.

How To Calculate 2019 Federal Income Withhold Manually

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Thats where our paycheck calculator comes in. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

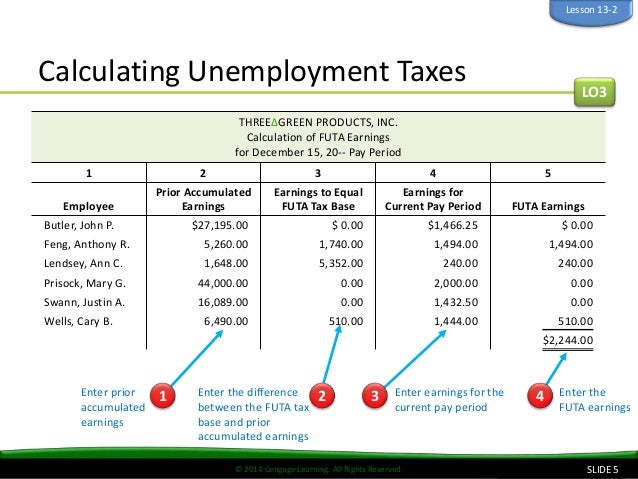

Improve the accuracy and efficiency of payroll non-wage and unemployment tax management. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Tax withheld for individuals calculator.

IRS tax forms. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Ad Compare This Years Top 5 Free Payroll Software. 250 and subtract the refund adjust amount from that. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

Free Unbiased Reviews Top Picks. The Tax withheld for individuals calculator is. Then look at your last paychecks tax withholding amount eg.

Exemption from Withholding. Ad See how tax withholding solutions from Sovos improve accuracy and efficiency. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Over 900000 Businesses Utilize Our Fast Easy Payroll. For employees withholding is the amount of federal income tax withheld from your paycheck. The withholding calculator is designed to assist taxpayers with tax planning and withholding.

Sign Up Today And Join The Team. Over 900000 Businesses Utilize Our Fast Easy Payroll. Learn About Payroll Tax Systems.

Ad GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. Get the Latest Federal Tax Developments. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes.

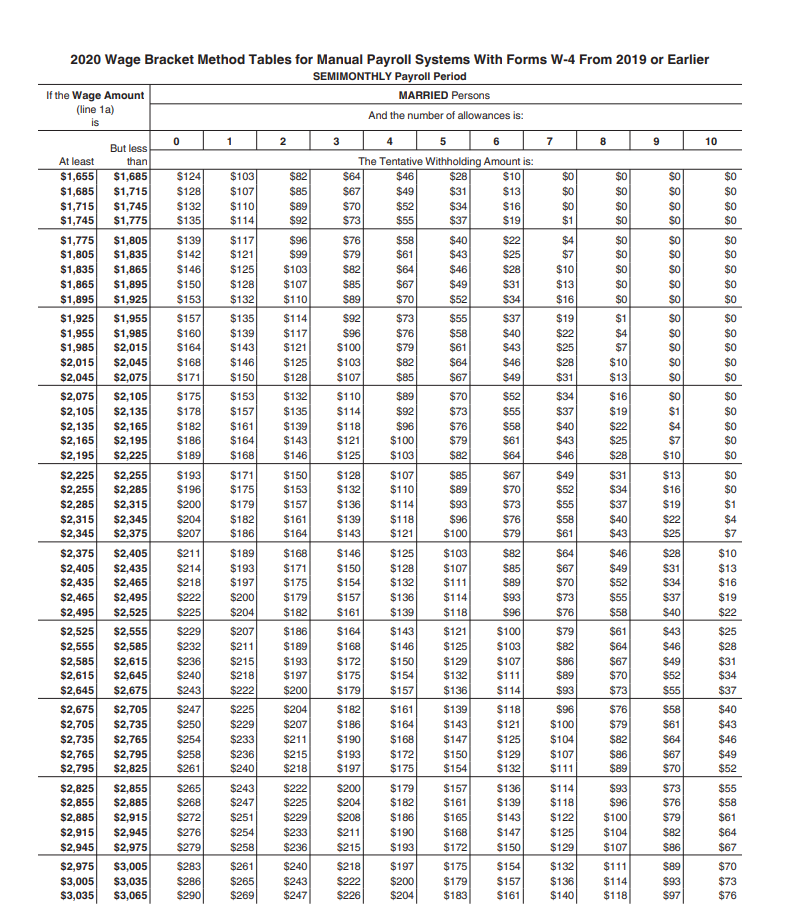

The calculator can help estimate Federal State Medicare and Social Security tax withholdings. The wage bracket method and the percentage method. Subtract 12900 for Married otherwise.

That result is the tax withholding amount. Please keep in mind that some circumstances may cause the amount of withholding tax that is. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

For example if an employee earns 1500. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Choose the right calculator. 250 minus 200 50. There are 3 withholding calculators you can use depending on your situation.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Estimate your paycheck withholding with our free W-4 Withholding Calculator. Learn About Payroll Tax Systems.

Computes federal and state tax withholding for. Accordingly the withholding tax. It will confirm the deductions you include on your.

How to calculate annual income. The amount of income tax your employer withholds from your regular pay. Sign Up Today And Join The Team.

There are two main methods small businesses can use to calculate federal withholding tax. To calculate an annual salary multiply the gross pay before tax deductions by. 2020 Federal income tax withholding calculation.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. The calculator includes options for estimating Federal Social Security and Medicare Tax.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Paycheck Calculator Take Home Pay Calculator

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

How To Calculate Federal Income Tax

How To Calculate Federal Withholding Tax Youtube

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

Free Payroll Tax Paycheck Calculator Youtube

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Tax Calculator For Employers Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com